Recent market responses to Federal Reserve moves update

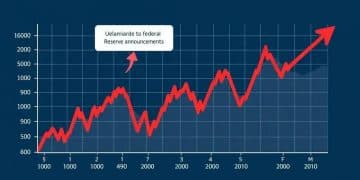

Recent market responses to Federal Reserve moves indicate significant impacts on sectors such as finance and real estate, reflecting changes in interest rates and influencing overall economic growth and investor strategies.

Recent market responses to Federal Reserve moves update shed light on how financial markets react to central bank decisions. As we navigate through these updates, it’s worth considering how this affects your investment strategy and the broader economy.

Current impact of Federal Reserve decisions

The actions of the Federal Reserve significantly influence the financial landscape. Understanding the current impact of Federal Reserve decisions helps investors make informed choices. Recent changes in interest rates and monetary policy can lead to fluctuations in various sectors.

Immediate Effects on the Market

When the Fed announces a rate change, the market reacts swiftly. Traders assess how these decisions affect borrowing costs and consumer spending. For example, lower interest rates can stimulate economic growth by making loans cheaper.

Sector Responses

Different sectors respond uniquely to Fed decisions. Here are some key areas:

- Financial Sector: Banks tend to benefit from rising rates as their profit margins on loans widen.

- Real Estate: Lower rates can boost the housing market by making mortgages more affordable.

- Consumer Goods: Higher borrowing costs may dampen sales as consumers hold back on spending.

The current impact of Federal Reserve decisions extends beyond immediate price movements. Long-term implications include shifts in investor sentiment and adjustments in financial strategies. Market players constantly reassess their positions based on the latest Fed guidance.

Another factor to consider is how these decisions affect inflation expectations. A well-communicated rate policy can enhance consumer confidence and stabilize markets. However, uncertainty can lead to volatility as investors react to potential risks.

Overall, monitoring the Fed’s moves is crucial for understanding market dynamics. By keeping an eye on interest rate trends and economic indicators, investors can navigate the complexities of the financial world more effectively.

Market sentiment and analysis post-meetings

Market sentiment can greatly shift following the Federal Reserve’s meetings. Understanding the market sentiment and analysis post-meetings is vital for investors. Traders closely watch the Fed’s announcements and comments to gauge future economic conditions.

Understanding Sentiment Shifts

When the Fed changes interest rates, it directly affects how investors feel about the market. A rate hike often leads to caution among traders. Conversely, if rates are cut, optimism tends to rise as borrowing becomes cheaper.

Factors Influencing Sentiment

Several elements play a role in shaping market sentiment after Fed meetings:

- Economic Indicators: Reports on employment, inflation, and GDP can either support or contradict the Fed’s decisions.

- Fed Chair’s Tone: The language used by the Fed Chair during statements can influence perceptions of uncertainty or confidence.

- Global Events: Political or economic events happening worldwide can also impact how investors react to the Fed’s announcements.

After each meeting, analysts evaluate these factors to understand the broader implications. Insights into investor behavior reveal trends that can guide future decisions. For instance, when uncertainty prevails, many investors may prefer to liquidate positions or choose safer assets.

Monitoring social media platforms and financial news can also provide insights into market sentiment changes. Traders share their views and analyses, which can create a ripple effect across the market. The market sentiment and analysis post-meetings highlight how quickly opinions can shift, impacting everything from stocks to bonds.

As the market reacts, experts compile analyses to help investors navigate the turbulent waters. These analyses highlight potential opportunities and risks, ensuring traders remain informed. Staying connected with reliable sources enables investors to adjust their strategies accordingly.

Sector-specific responses to interest rate changes

Understanding the sector-specific responses to interest rate changes is crucial for investors. Different sectors react uniquely when the Federal Reserve adjusts interest rates. These responses can either create opportunities or pose risks, depending on how companies within those sectors manage their finances.

Financial Sector

The financial sector is often the first to feel the effects of interest rate changes. When rates rise, banks and financial institutions typically see an increase in their profit margins. Higher rates lead to increased revenues from loans as interest payments rise.

Real Estate Sector

The real estate sector exhibits a different reaction. Lower interest rates tend to boost demand for residential and commercial properties. When borrowing costs are cheap, more buyers are likely to enter the market, increasing sales and property values. Conversely, when rates rise, affordability decreases, leading to a slower market. Factors to consider include:

- Mortgage Rates: As rates climb, borrowing costs for homebuyers increase.

- Investment Properties: Higher costs may deter investors from purchasing new properties.

- Rental Market: Increased rates can lead to higher rents as landlords adjust to cover costs.

The consumer goods sector also responds to changes in interest rates. Higher rates can lead to cautious spending habits among consumers. When borrowing becomes more expensive, individuals may delay large purchases or reduce discretionary spending. This shift can negatively impact sales for retailers.

On the other hand, utilities and essential services are typically less sensitive to interest rate changes. These sectors provide essential services, and consumers generally continue to pay for utilities regardless of rates. As a result, these sectors tend to be more stable during periods of rate fluctuations. Investors view them as safe havens.

Overall, understanding how different sectors react to interest rate changes assists investors in making strategic decisions. By tracking sector performance and adjusting investment strategies accordingly, traders can better navigate the complexities of the financial market.

Long-term implications for the economy

The long-term implications for the economy of Federal Reserve decisions are crucial for understanding future market conditions. When the Fed adjusts interest rates, it impacts various economic factors, including growth, inflation, and employment levels.

Growth Trends

Long-term economic growth can be significantly influenced by the Fed’s monetary policy. When interest rates are low, borrowing becomes easier for businesses and consumers. This can lead to increased investment and spending, promoting economic expansion. However, if rates are too high for extended periods, it can slow growth and create an environment of caution among investors.

Inflation Control

Inflation is another critical aspect affected by interest rate changes. The Federal Reserve aims to maintain price stability, often targeting a specific inflation rate. When rates are increased, it helps to cool down an overheating economy, which can prevent runaway inflation. On the other hand, if rates are kept too low for too long, it may spur higher inflation, affecting purchasing power and savings.

- Investment Levels: Higher rates can discourage new investments as borrowing costs rise.

- Consumer Prices: Inflation can erode consumer purchasing power over time, leading to economic strain.

- Savings Rates: Increased rates can encourage savings, impacting overall consumption.

Employment rates also react to Federal Reserve policies. A growing economy often leads to job creation, while a stagnant economy may result in job losses. The Fed’s rate decisions play a crucial role in creating a favorable environment for employment growth.

Additionally, sectors such as housing and manufacturing can feel the long-term impact more acutely. For example, the housing market may slow down if mortgage rates climb too quickly, leading to fewer housing starts and reduced economic activity. The manufacturing sector may also face challenges if borrowing for capital investments becomes less attractive.

Overall, understanding the long-term implications for the economy of Federal Reserve actions allows investors and policymakers to better anticipate economic cycles. By keeping an eye on these developments, businesses can adapt their strategies to align with shifting economic conditions.

Expert opinions on future moves by the Fed

Understanding expert opinions on future moves by the Fed can provide valuable insights for investors and policymakers. Financial analysts and economists keep a close eye on indicators and trends to predict how the Federal Reserve may adjust its monetary policy.

Current Trends and Signals

Experts analyze various economic signals to anticipate the Fed’s next steps. Unemployment rates, inflation levels, and consumer spending data all play significant roles in shaping predictions. For example, if inflation continues to rise above the Fed’s target, analysts might suggest a series of rate hikes.

Market Reactions and Predictions

After each Fed meeting, analysts share their forecasts based on the information released. Many believe that the Fed will remain proactive in addressing any economic slowdown.

- Rate Hikes: If inflation persists, some experts argue that the Fed may increase interest rates at a faster pace.

- Economic Growth: A strong labor market may encourage the Fed to continue its current policy of gradual rate increases.

- Global Influence: Global economic conditions can also impact the Fed’s decisions. Experts monitor international markets closely for cues.

The tone set by the Fed Chair during press conferences can influence expert predictions significantly. A hawkish tone may signal future tightening of monetary policy, while a dovish tone could suggest a more cautious approach.

Some experts might even explore unconventional measures the Fed could take if economic conditions worsen, such as implementing negative interest rates or increasing asset purchases. Keeping track of these discussions helps investors understand the potential direction of monetary policy.

Additionally, experts emphasize the importance of ongoing communication from the Fed to maintain market confidence. Clear guidance regarding their policy framework can help stabilize expectations and reduce volatility.

FAQ – Frequently Asked Questions About Federal Reserve Moves

How do Federal Reserve interest rate changes affect the economy?

Interest rate changes directly impact borrowing costs, consumer spending, and overall economic growth.

What sectors are most sensitive to Fed policies?

The financial, real estate, and consumer goods sectors typically react strongly to changes in interest rates.

Why is market sentiment important after Fed meetings?

Market sentiment helps investors understand potential future market movements and adjust their strategies accordingly.

How can I stay informed about Federal Reserve decisions?

Following financial news, analysts’ reports, and official Fed communications can help you stay updated on their policies.