Projected market responses to Federal Reserve moves

Projected market responses to Federal Reserve moves are driven by key indicators like inflation rates and employment statistics, which dictate investor strategies during announcements.

Projected market responses to Federal Reserve moves can have a profound impact on your financial decisions. Ever wondered how these shifts influence interest rates and investment opportunities? Let’s explore this fascinating topic together.

Understanding the Federal Reserve’s role in the economy

The Federal Reserve plays a crucial role in the U.S. economy, acting as the central bank that manages monetary policy. Understanding how the Fed operates can help you grasp the bigger picture of economic fluctuations.

Key Functions of the Federal Reserve

The Fed has several key functions that directly impact the economy. These include:

- Regulating and supervising banks to ensure stability.

- Setting interest rates to influence economic activity.

- Controlling inflation to maintain purchasing power.

By adjusting the federal funds rate, the Fed can stimulate or cool down the economy. Lower rates typically encourage borrowing and spending, while higher rates aim to curb inflation.

The Impact of Monetary Policy

When the Federal Reserve changes its monetary policy, it sends signals to the market. These signals can lead to immediate responses in stock prices and investment behaviors. Investors often react to anticipated rate changes by adjusting their portfolios.

Moreover, the Fed’s decisions affect consumer confidence. For example, if the Fed raises rates, consumers may be less inclined to take on new loans or credit, affecting overall spending. Understanding these dynamics is critical for anyone involved in investing.

The Federal Reserve also engages in open market operations, buying and selling government securities to influence liquidity in the banking system. This practice impacts the money supply and ultimately shapes economic conditions.

Investors monitor the Fed closely, as its actions can predict market trends. By staying informed about the Fed’s policy changes, you can make better financial decisions.

Key indicators of market responses

Understanding key indicators of market responses is essential for navigating the complexities of financial markets. Investors rely on these metrics to gauge the potential impact of Federal Reserve actions on their portfolios.

Major Economic Indicators

Several economic indicators serve as bellwethers for market reactions. These include:

- Gross Domestic Product (GDP): A rising GDP usually signifies economic growth, which can lead to higher interest rates.

- Unemployment Rate: Low unemployment can indicate a strong economy, influencing the Fed’s decisions on rate adjustments.

- Consumer Price Index (CPI): This measures inflation and helps the Fed assess the necessity of interest rate changes.

Monitoring these indicators gives investors a clearer picture of how markets may respond to any Federal Reserve moves. For instance, a sudden rise in CPI may prompt the Fed to raise interest rates sooner than anticipated.

Market Sentiment and Volatility

Market sentiment, driven by news and events, can also influence responses. When investors feel optimistic, stock prices may rise, even if the economic indicators are mixed. On the other hand, uncertainty or negative news can lead to increased volatility.

Another important aspect is how quickly the markets react. The stock market often responds to news before the data is fully analyzed. This immediate reaction can create opportunities for savvy investors who stay informed.

In addition to market sentiment, investor behavior during times of Fed announcements can create significant movement. Understanding how traders typically behave in response to certain signals can provide valuable insights.

Ultimately, recognizing these key indicators allows investors to prepare for potential changes and adjust their strategies accordingly.

Historical trends and their implications

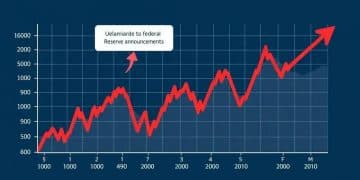

Historical trends reveal much about how markets respond to the actions of the Federal Reserve. By examining past reactions, we can gain valuable insights into possible future outcomes.

Patterns in Market Responses

Historically, significant changes in Federal Reserve policy have led to various market fluctuations. For example, when the Fed cuts interest rates, markets often respond positively. During these times, investors typically feel more confident and are more likely to invest in stocks.

- In the late 2000s, the Fed lowered rates to combat the financial crisis, resulting in a prolonged stock market recovery.

- Conversely, when rates rise, markets can experience volatility as investors adjust their strategies.

- Following the rate increases in 2015, there were noticeable fluctuations in market performance, illustrating investor caution.

Understanding these patterns helps investors anticipate how current policies might affect the markets. For instance, if the Fed signals potential rate hikes, investors may brace for a market downturn based on historical precedents.

Economic Cycles and Fed Actions

Economic cycles also play a significant role in how markets respond to the Federal Reserve’s decisions. During periods of expansion, low-interest rates tend to stimulate growth, encouraging consumer spending. This can lead to higher stock prices.

However, during downturns, the Fed’s actions may differ. They might implement quantitative easing, buying government securities to inject liquidity into the market. This practice has been particularly evident during economic shocks, such as the COVID-19 pandemic.

Investors who pay attention to these historical trends can better navigate their own financial strategies. Keeping an eye on how similar situations have unfolded in the past can provide a roadmap for future investments.

Overall, recognizing the implications of these historical patterns is essential for developing a well-rounded investment strategy.

Strategies for investors during Federal Reserve announcements

Adapting to Federal Reserve announcements is crucial for investors looking to safeguard their portfolios and seize opportunities. Understanding strategies to implement during these moments can maximize gains while minimizing risks.

Stay Informed and Prepare

Before an announcement, investors should stay updated on economic indicators and the Fed’s potential actions. This preparation allows for informed decisions. Some effective strategies include:

- Follow economic reports: Regularly check reports like GDP, job data, and inflation indices.

- Listen to speeches: Fed officials often give clues about future policies in their public addresses.

- Market sentiment analysis: Understand the general mood of the market by following expert analyses and reports.

Being proactive is key. If investors anticipate a rate change, they can adjust their strategies accordingly, whether that means buying assets expected to rise or hedging against potential declines.

Implementing Risk Management Techniques

During times of uncertainty, having strong risk management techniques in place is imperative. This can help investors withstand unexpected market volatility after announcements.

Some techniques worth considering include:

- Diversification: Spread investments across various sectors to mitigate risk.

- Stop-loss orders: These can prevent significant losses if a stock drops below a certain price.

- Options trading: Using options can provide protection against market downturns.

By implementing these strategies, investors can navigate the uncertainty that often follows Federal Reserve announcements. It is vital to remain aware of the changes and adjust plans as necessary.

In conclusion, understanding how to strategically respond to Federal Reserve announcements can empower investors to make confident, informed choices during market fluctuations.

Future outlook: Predictions and considerations

Looking ahead, the future outlook regarding the Federal Reserve’s impact on the economy is filled with uncertainties and opportunities. By analyzing current trends, investors can make educated predictions.

Current Economic Indicators

Several key economic indicators will influence the Fed’s decisions moving forward. Watching these closely can provide insights into expected future actions. Some important indicators include:

- Inflation rates: If inflation continues to rise, the Fed may be compelled to increase interest rates to maintain economic stability.

- Employment statistics: Strong job growth typically signals a healthy economy, which can lead to higher interest rates if inflation persists.

- Consumer spending: Higher consumer spending can boost economic growth but might also contribute to inflation pressures.

These indicators will play a crucial role in shaping the Fed’s monetary policy in the coming months.

Market Reactions to Predictions

As new predictions and signs emerge, markets usually react quickly. Investors must stay nimble and adjust their strategies to fit the evolving landscape. For example, if the Fed hints at a tightening policy, stocks may drop as investors reassess risk.

Conversely, if the outlook suggests maintained or reduced rates, market sentiment might improve. During such times, sectors such as technology often thrive due to lower borrowing costs. Understanding these dynamics can position investors effectively.

Ultimately, keeping up with the Fed’s outlook and market predictions allows investors to navigate the financial landscape wisely. Being aware of how political and global events can shift economic expectations is equally important.

FAQ – Frequently Asked Questions about Projected Market Responses to Federal Reserve Moves

What are key indicators to watch for market responses?

Key indicators include inflation rates, employment statistics, and consumer spending, which influence how investors react to Federal Reserve policies.

How can historical trends help investors?

By examining historical trends, investors can understand past market reactions to similar Federal Reserve actions and anticipate future movements.

What strategies should investors use during Fed announcements?

Investors should stay informed about economic reports and use risk management techniques like diversification and stop-loss orders to protect their portfolios.

How important is it to monitor the Fed’s future outlook?

Monitoring the Fed’s future outlook is crucial as it helps investors make informed decisions and adapt their strategies to changing market conditions.