Market responses to Federal Reserve moves impact stocks

Market responses to Federal Reserve moves significantly impact stock performance, with changes in interest rates affecting investor sentiment and market volatility, necessitating adaptive investment strategies.

Market responses to Federal Reserve moves impact our financial landscape in ways many might not immediately realize. When the Fed makes a decision, it can shake the entire market. Have you considered how these shifts influence your investments?

Understanding the Federal Reserve’s role in the economy

Understanding the Federal Reserve’s role in the economy is essential for grasping how financial systems operate. The Federal Reserve, often referred to as the Fed, manages the United States’ monetary policy. This means they help control the money supply and interest rates, which affect everything from inflation to employment.

The Federal Reserve plays a crucial part in maintaining economic stability. In times of economic uncertainty, such as a recession, the Fed can lower interest rates to encourage borrowing. When borrowing increases, consumer spending often rises, leading to economic growth. Conversely, in a booming economy, the Fed may raise interest rates to curb excessive spending and inflation.

The key functions of the Federal Reserve

Here are the primary functions of the Fed:

- Conducting monetary policy: Adjusting interest rates to influence economic growth.

- Supervising and regulating banks: Ensuring financial institutions operate safely and soundly.

- Maintaining financial stability: Acting as a lender of last resort during financial crises.

- Facilitating payments: Overseeing the nation’s payment systems and ensuring their efficiency.

Another important aspect is the Fed’s role in setting the federal funds rate, the interest rate at which banks lend to one another overnight. This rate influences other interest rates throughout the economy, impacting mortgages, loans, and savings accounts. The Fed meets regularly to review economic indicators and decide whether to raise, lower, or maintain the federal funds rate.

The impact of the Federal Reserve’s decisions

The decisions made by the Federal Reserve can significantly affect the stock market, investment strategies, and the overall economy. When the Fed adjusts rates, it causes reactions in the market. Investors tend to react quickly to these changes, leading to fluctuations in stock prices and investment opportunities.

Understanding the Federal Reserve’s role helps investors and everyday consumers make informed decisions. As the Fed influences the economy, it also impacts job creation, spending habits, and overall growth.

In conclusion, the Federal Reserve is a vital institution in the U.S. economy. By adjusting monetary policy, supervising financial institutions, and maintaining stability, the Fed plays a central role in promoting economic health.

How federal moves influence market volatility

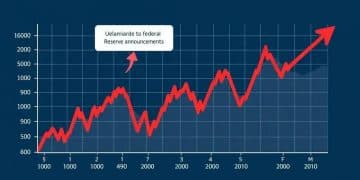

Federal moves can significantly influence market volatility, affecting how investors react to economic events. When the Federal Reserve announces changes in monetary policy, such as altering interest rates, it creates ripples throughout the financial markets. These decisions can lead to swift changes in stock prices, reflecting investor sentiment.

For instance, when the Fed cuts interest rates, borrowing becomes cheaper for both consumers and businesses. This can lead to increased spending and investment, which often results in a rise in stock prices. On the other hand, if the Fed raises rates to combat inflation, market uncertainty may increase. Investors might sell off stocks, fearing decreased profits.

Factors that contribute to market volatility

Several factors play into the volatility of the markets following federal moves:

- Investor sentiment: Changes in consumer and investor confidence can directly affect market behaviors.

- Global events: Economic situations in other countries can influence reactions to U.S. federal policies.

- Economic indicators: Reports on employment rates, GDP growth, and inflation can impact how investors react to the Fed’s decisions.

- Speculation: Traders often react to predictions and expectations, leading to volatility even before official federal announcements.

The timing of federal announcements also plays a role in market reactions. For example, an unexpected change in policy may lead to greater volatility than a well-anticipated decision. Investors tend to react quickly, and their immediate responses can create fluctuations in stock prices.

Understanding how federal moves influence market volatility is crucial for investors. By staying informed, they can better strategize their investments and anticipate market movements. With the right knowledge, individuals can minimize risks and seize opportunities in a fluctuating market.

The connection between interest rates and stock performance

The connection between interest rates and stock performance is a critical concept in finance. When the Federal Reserve sets interest rates, it indirectly affects the stock market. Generally, lower interest rates create a favorable environment for stocks. This is because cheap borrowing costs encourage companies to invest and expand.

As companies grow, their profits may rise, which often leads to higher stock prices. Conversely, when the Fed increases interest rates to curb inflation, it can lead to higher borrowing costs. Companies might limit their spending, causing slower growth and potentially lower stock prices.

How interest rate changes affect consumers and companies

Interest rate fluctuations can also impact consumer behavior. Here are key effects:

- Mortgage rates: Higher rates can lead to fewer home purchases, impacting construction and real estate stocks.

- Credit costs: Increased rates can make loans more expensive, discouraging consumer spending.

- Savings returns: Higher interest rates can encourage saving rather than spending, affecting retail stock performance.

- Investment strategies: Investors often shift their strategies based on expected interest rate changes, influencing stock market dynamics.

In addition, analysts closely watch indicators like inflation and unemployment. These factors influence the Fed’s decisions on interest rates, which in turn affects stock performance. For example, if inflation is rising, the Fed might raise rates to cool down the economy. This reaction can lead to increased volatility in the stock market as investors react to these changes.

Understanding the relationship between interest rates and stock performance is essential for investors. By making informed decisions based on interest rate movements, individuals can navigate the stock market more effectively.

Investor sentiment during federal policy shifts

Investor sentiment during federal policy shifts can greatly influence market trends. When the Federal Reserve announces new policies, investors often react quickly based on their expectations for the economy. This reaction can create fluctuations in stock prices, even before the full impact of policies is felt.

For example, if the Fed lowers interest rates, many investors may feel optimistic about future economic growth. They might increase their investments in stocks, driving prices up. On the other hand, if the Fed raises rates unexpectedly, investor confidence might decline, leading to sell-offs and decreased stock values.

Key factors affecting investor sentiment

Several factors can influence how investors feel during these policy changes:

- Media coverage: News reports can shape perceptions and reactions to federal policies.

- Market analysts: Predictions and analyses from financial experts can impact investor confidence.

- Economic indicators: Data on employment, inflation, and growth can influence sentiment regarding policy effectiveness.

- Global events: Political and economic events overseas can also affect U.S. investor sentiment.

As federal policies shift, investors closely monitor communication from the Fed. Statements from officials can signal future directions and impact sentiment. For instance, a positive outlook can encourage buying, while cautionary words may lead to hesitance.

Understanding investor sentiment allows individuals to navigate market fluctuations effectively. By considering how federal policies impact perceptions, investors can make more informed decisions. This awareness can lead to better investment strategies during periods of uncertainty.

Strategies for adapting to federal reserve changes

Strategies for adapting to Federal Reserve changes are essential for investors looking to maintain their portfolios during economic shifts. When the Fed alters interest rates or implements new policies, understanding how to react can make a significant difference in investment success.

One common strategy is to diversify investments. By spreading portfolios across different asset classes, such as stocks, bonds, and real estate, investors can reduce risk. This diversification can help buffer against volatility that may occur after federal announcements.

Key strategies to consider

Investors should also focus on these strategies:

- Stay informed: Keep up with Fed announcements and economic indicators. This knowledge enables better decision-making.

- Adjust asset allocation: If interest rates rise, consider reallocating funds to sectors that thrive in a higher-rate environment, like financial stocks.

- Evaluate risk tolerance: Regularly assess personal risk levels and adjust investments accordingly to maintain comfort during market changes.

- Utilize market tools: Consider using market tools and analytics to track how federal decisions affect investments.

Another effective approach is to adopt a long-term perspective. Instead of reacting quickly to every rate change, investors should focus on their overall goals. This mindset helps to mitigate emotional responses that can lead to poor decisions.

Finally, working with a financial advisor can provide valuable insights. Advisors can help navigate complex market conditions and create personalized strategies that align with individual financial goals.

In summary, understanding market responses to Federal Reserve moves is crucial for investors. By recognizing how interest rates and policy changes impact stock performance, individuals can make informed decisions. Strategies for adapting to these shifts include diversifying investments and staying informed about economic indicators. By maintaining awareness and adjusting approaches accordingly, investors can navigate the financial landscape more effectively. Ultimately, being prepared for federal changes can lead to better investment outcomes.

FAQ – Frequently Asked Questions about Market Responses to Federal Reserve Moves

How do Federal Reserve changes affect stock prices?

Federal Reserve changes influence stock prices by altering interest rates, which affects borrowing costs and corporate profitability.

What strategies should I use to adapt to Fed policy shifts?

You should diversify your investments, stay informed about economic indicators, and consider a long-term perspective.

Why is investor sentiment important during federal policy changes?

Investor sentiment can lead to swift market reactions, affecting stock prices before policies fully take effect.

How can I stay informed about Federal Reserve announcements?

You can follow financial news outlets, subscribe to market analysis reports, and monitor the Federal Reserve’s official website.