Impact of inflation on corporate earnings in 2025

The impact of inflation on corporate earnings in 2025 varies by sector, necessitating effective cost management and adaptive pricing strategies to preserve profit margins amidst rising costs.

The impact of inflation on corporate earnings in 2025 is shaping how investors and companies strategize moving forward. With shifting economic landscapes, understanding these dynamics can offer crucial insights for future decisions. Are you prepared for what’s ahead?

Understanding inflation and its economic effects

Understanding inflation is crucial for anyone looking to navigate the economic landscape. Inflation refers to the rate at which the general level of prices for goods and services rises, eroding purchasing power. In simple terms, when inflation increases, each dollar buys fewer products. This phenomenon doesn’t just affect consumers; it also has significant implications for businesses and corporate earnings.

The economic effects of inflation

Inflation can have various consequences on the overall economy. As prices rise, costs for businesses also increase. This situation can lead to reduced profit margins unless companies can pass these costs onto consumers. Understanding these effects is essential for forecasting future corporate performance.

How inflation impacts consumer behavior

When consumers perceive rising prices, they may adjust their spending habits. This shift can lead to:

- Increased focus on budget-friendly options.

- Decreased spending on luxury goods.

- Higher demand for discounts and sales.

As consumers become more cautious, businesses must adapt their strategies accordingly. This behavior can significantly influence a company’s sales and ultimately its earnings.

Moreover, inflation can impact interest rates, which in turn affect borrowing costs for businesses. If companies face higher interest rates, they may reduce investments in expansion or innovation. This aspect can further lead to slower growth, affecting long-term profitability.

Sector-specific impacts

Different sectors respond to inflation in unique ways. For example, the technology industry may withstand inflation better than the retail sector. While tech companies often have the flexibility to raise prices without losing customers, retailers might face backlash if they increase prices too much. Understanding these variations is key to predicting which sectors might outperform in an inflationary environment.

Projected trends in inflation for 2025

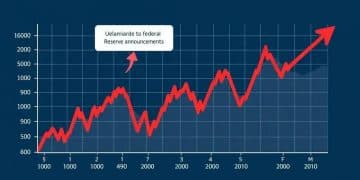

Projected trends in inflation for 2025 provide insights into what consumers and businesses can expect in the near future. Understanding these trends is vital for making informed financial decisions. As we look ahead, various factors can influence the rate of inflation and its impact on the economy.

Factors influencing inflation

Several elements contribute to inflation trends. These can include:

- Supply chain disruptions that increase costs.

- Changes in consumer demand for goods and services.

- Monetary policies enacted by central banks.

The interaction of these factors will shape the inflation landscape. For example, if consumer demand remains high while supply chains are constrained, prices are likely to rise. On the other hand, effective monetary policies could help mitigate inflationary pressures.

Inflation forecasts for specific sectors

Different sectors expect varied inflation rates, reflecting their unique challenges and opportunities. In the technology sector, for instance, rapid innovation may help offset some price increases. In contrast, the manufacturing sector may struggle more with rising raw material costs.

Analysts predict that sectors like real estate could also experience significant inflation due to ongoing housing demand. Understanding which sectors are more vulnerable helps investors make strategic decisions. Keeping an eye on these trends allows businesses to plan for potential challenges ahead.

Overall, the inflation landscape for 2025 appears to be influenced by both external factors like global events and internal factors such as consumer behavior. It’s essential for businesses to stay informed about these trends to adapt their strategies effectively.

How inflation influences corporate profit margins

How inflation influences corporate profit margins is a key concern for businesses in any economic climate. As prices rise, the cost of goods and services increases, which can squeeze profit margins if companies cannot pass these costs onto customers. Understanding this relationship is essential for financial planning and strategy.

The relationship between costs and pricing

When inflation increases, businesses face rising costs for materials, labor, and overhead. If companies increase their prices to maintain margins, they risk losing customers who might seek cheaper alternatives. This relationship creates a delicate balance between sustaining profitability and staying competitive in the market.

Impact on different industries

Different industries experience inflationary pressures in unique ways. For example:

- Retail: Retailers may absorb some costs to maintain customer loyalty but must eventually raise prices.

- Manufacturing: Manufacturers often face significant increases in raw material costs, directly impacting their profit margins.

- Service Providers: Service-oriented businesses may find it easier to adjust prices quickly, depending on the demand elasticity.

Each industry must craft its own strategies to manage these inflation impacts effectively. Companies in highly elastic markets might emphasize cost efficiencies while those in less elastic markets could afford to increase prices more easily.

Moreover, inflation can lead to changes in consumer behavior. As prices rise, customers might prioritize essential goods over luxury items. This change in purchasing habits can lead to shifts in demand, which affects corporate profit margins either positively or negatively.

Ultimately, navigating inflation requires a proactive approach. Businesses must continually monitor economic indicators, adjust pricing strategies, and explore cost-saving measures to protect their profit margins. This adaptability is essential for long-term sustainability.

Sector-specific impacts of inflation on earnings

Sector-specific impacts of inflation on earnings reveal how different industries respond to rising prices. Inflation does not affect all sectors equally, and understanding these differences can help investors make informed decisions.

Understanding sector sensitivities

Some sectors are more sensitive to inflation than others. For example:

- Consumer Goods: Companies that produce everyday products may struggle as consumers become more price-sensitive. If inflation rises, these companies might have to choose between absorbing costs or increasing prices.

- Technology: Tech firms often have higher profit margins, allowing them to adjust prices more easily. However, if inflation leads to increased component costs, this sector might still face margin pressures.

- Energy: The energy sector can benefit from inflation, as the price of oil and gas typically rises. This sector may see increased earnings if it effectively passes those costs to consumers.

Additionally, the real estate market can experience significant impacts. Rising costs can lead to higher rents, affecting both tenants and landlords. Conversely, inflation can lead to increased property values, benefiting owners. As these dynamics unfold, companies must be agile to adjust their strategies based on sector-specific trends.

Moreover, inflation can affect consumer spending patterns, which further influences sector performance. For example, during inflationary periods, consumers may prioritize essential goods rather than luxury items, shifting sales dynamics within various sectors.

With all this in mind, each sector requires a tailored strategy to navigate inflation. Understanding how these factors interplay will be essential for businesses aiming to protect their earnings amidst fluctuating economic conditions.

Strategies for navigating inflationary pressures

Strategies for navigating inflationary pressures are essential for businesses aiming to maintain profitability in challenging economic times. As inflation rises, companies need to adapt their operations to protect their margins and continue to thrive.

Cost Management Techniques

One critical strategy is to implement effective cost management techniques. Businesses can:

- Negotiate with suppliers: Building strong relationships can lead to better pricing and terms, especially in volatile markets.

- Optimize supply chains: Streamlining processes and reducing waste can lower costs significantly.

- Invest in technology: Automating processes can improve efficiency and reduce labor costs over time.

By focusing on these areas, companies can mitigate the impact of rising costs on their overall profitability.

Pricing Strategies

Another important approach is revising pricing strategies. Firms may consider:

- Implementing dynamic pricing: Adjusting prices based on market conditions can help maintain margins without alienating customers.

- Offering tiered pricing: Providing options at different price points can cater to various consumer segments while maximizing revenue.

- Communicating value: Educating customers about the benefits of your products justifies price increases and builds loyalty.

Implementing these strategies helps ensure that businesses remain competitive, even as consumer price sensitivity shifts.

Additionally, monitoring economic indicators is crucial. Keeping an eye on inflation rates, interest rates, and consumer sentiment can inform strategic decisions. By being proactive, businesses can adjust their strategies in real time, enhancing their ability to ride out inflationary pressures.

Ultimately, adopting a combination of these strategies can position companies to not just survive inflation but emerge stronger as the economy stabilizes.

FAQ – Frequently Asked Questions about the Impact of Inflation on Corporate Earnings

How does inflation affect corporate profit margins?

Inflation increases costs for materials and labor, which can squeeze profit margins if companies cannot pass these costs onto customers.

What strategies can businesses use to navigate inflation?

Businesses can manage costs, revise pricing strategies, and closely monitor economic indicators to adapt to inflationary pressures.

Which sectors are most affected by inflation?

Consumer goods, energy, and real estate sectors often experience varied impacts from inflation due to their unique price sensitivities and market dynamics.

Why is monitoring economic trends important for businesses?

Keeping an eye on inflation rates and consumer behavior helps businesses make informed decisions and adjust strategies effectively to maintain profitability.