Federal Reserve releases new economic outlook that matters

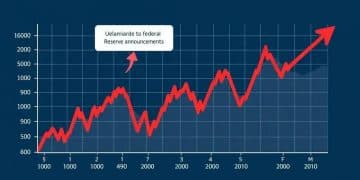

The Federal Reserve releases new economic outlook to provide insights on key indicators like GDP, inflation, and employment, helping businesses and consumers make informed financial decisions.

The Federal Reserve releases new economic outlook periodically, providing insights that can shape financial landscapes. But what does it truly mean for you and the economy?

Understanding the Federal Reserve’s role in the economy

The Federal Reserve plays a crucial role in shaping the U.S. economy. By adjusting interest rates and controlling the money supply, it aims to promote maximum employment and stable prices. Understanding its function helps us grasp how it can impact our financial lives.

Key Functions of the Federal Reserve

The Federal Reserve conducts various functions to manage the economy effectively.

- Monetary Policy: It influences money supply and interest rates.

- Regulation: It supervises and regulates banks to ensure safety and soundness.

- Financial Services: It offers services to depository institutions and the U.S. government.

- Payment Systems: It maintains efficient payment systems.

By utilizing these functions, the Federal Reserve aims to maintain economic stability. For instance, when inflation rises, the Fed may increase interest rates to cool down the economy. This tactic can influence consumer spending and borrowing.

The Impact on Consumers

Changes made by the Federal Reserve affect everyday consumers. Interest rates on loans and mortgages typically increase if the Fed raises rates. This could mean higher payments for those looking to borrow money.

Conversely, lower rates may make it cheaper to borrow, encouraging spending. This balance is essential for fostering economic growth, as the Fed attempts to navigate between inflation and unemployment.

Understanding the Fed’s role is vital for staying informed about how these economic shifts might affect personal finances.

Key takeaways from the latest economic outlook

Analyzing the latest economic outlook can provide valuable insights into future economic trends. These reports help businesses, investors, and consumers make informed decisions.

Current Economic Indicators

The recent outlook highlights several key economic indicators that are essential for understanding the state of the economy.

- Inflation Rates: How inflation trends are evolving month over month.

- Employment Figures: Current job growth and unemployment rates.

- Consumer Spending: Trends in retail sales and consumer confidence.

- Interest Rates: Forecasts on how interest rates may change in the near future.

This data paints a picture of where the economy is heading. For example, rising inflation might cause the Federal Reserve to consider tightening monetary policy to stabilize prices. This can lead to changes in borrowing costs for consumers and businesses.

Implications for Different Sectors

Different sectors of the economy react uniquely to changes in these indicators. For instance, if consumer spending increases, retailers may benefit significantly. However, rising inflation could squeeze margins for some businesses.

Investors should pay close attention to shifts in the economic outlook, as this may influence stock performance in various sectors. Moreover, businesses must be agile to adapt to these changing conditions.

Understanding the key takeaways from the latest economic outlook can equip individuals and organizations to navigate the coming months more effectively.

Implications for businesses and consumers

The economic outlook shared by the Federal Reserve has significant implications for both businesses and consumers. Understanding these effects helps us prepare for changes in the economic environment.

Effects on Businesses

Businesses often feel the direct impact of changes in interest rates and inflation. For example, when the Federal Reserve raises interest rates, borrowing costs for companies can increase. This can make it more expensive for businesses to finance new projects or expand operations.

- Investment Decisions: Higher borrowing costs may lead companies to delay or scale back investments.

- Pricing Strategies: Businesses may need to adjust their pricing to maintain profit margins, especially if costs rise due to inflation.

- Consumer Demand: Changes in interest rates can affect consumer spending, which directly impacts sales.

- Employment: Companies may slow hiring or reduce staff if economic conditions become uncertain.

These decisions can create a ripple effect throughout the economy, influencing overall economic growth.

Impact on Consumers

For consumers, the implications are equally important. Changes in interest rates affect loans, mortgages, and credit card rates. As these rates fluctuate, so do the costs of borrowing money.

If the Federal Reserve increases interest rates, consumers may see higher payments on home loans. This can limit their ability to purchase homes or make significant purchases. On the other hand, lower rates can make borrowing more attractive and encourage consumer spending.

Understanding how the economic outlook affects personal finances is crucial. Consumers should be aware of potential changes in their financial situations and plan accordingly.

How to adapt to changing economic conditions

Adapting to changing economic conditions is essential for both consumers and businesses. As the economic landscape shifts, staying flexible and informed can make a significant difference.

Strategies for Businesses

Businesses must respond quickly to changes in the economy. Here are some effective strategies:

- Diverse Offerings: Companies should consider expanding their product or service range to meet varying consumer demands.

- Cost Management: Keeping a close eye on expenses can help businesses stay profitable during challenging times.

- Market Research: Regularly researching market trends enables businesses to anticipate shifts and adapt accordingly.

- Agile Operations: Implementing agile practices allows businesses to pivot quickly in response to market changes.

By employing these strategies, businesses can position themselves for success, no matter how the economy shifts.

Tips for Consumers

Consumers can also take proactive steps to adapt to changing conditions. Managing personal finances wisely ensures greater stability.

For instance, building an emergency fund can cushion against unexpected economic downturns. Being smart about spending and avoiding unnecessary debt can secure financial well-being. Tracking and adjusting budgets based on economic trends is another effective tactic.

Understanding the economic climate also helps consumers make informed decisions about investments and significant purchases. Being aware of personal finances allows individuals to navigate uncertainties more confidently.

Future predictions based on economic trends

Understanding future predictions based on economic trends is essential for making informed decisions. Various indicators can help us grasp where the economy is headed, particularly how they affect both individuals and businesses.

Key Economic Indicators

Several key indicators play a vital role in forecasting economic trends. These include:

- Gross Domestic Product (GDP): A rise in GDP often signals a growing economy, while a decline can suggest contraction.

- Unemployment Rates: High unemployment may indicate economic struggles, while low rates suggest a healthy job market.

- Consumer Confidence Index: This measure reflects how consumers feel about the economy and can influence spending behaviors.

- Inflation Rates: Keeping inflation in check is crucial, as unchecked inflation can erode purchasing power.

By monitoring these factors, analysts can form predictions about economic performance and stability.

Potential Outcomes

Predictions based on current economic trends can lead to various future outcomes. If the economy continues to grow, consumers may benefit from more job opportunities and higher wages. This could stimulate spending and further economic expansion.

On the other hand, if inflation rises significantly, the Federal Reserve may need to increase interest rates to stabilize prices. This could lead to decreased borrowing and less spending.

Consumers and businesses alike need to stay informed about these trends. Developing a strategy to navigate potential economic changes can help mitigate risks associated with unforeseen downturns.

Understanding the economic outlook is essential for navigating today’s financial landscape. By keeping an eye on key indicators and trends, both businesses and consumers can make informed decisions. Adapting to changes is crucial, whether it’s adjusting spending habits or modifying business strategies. As the Federal Reserve releases new forecasts, it’s vital to stay informed and proactive. Being prepared for potential shifts can lead to greater financial stability and success, no matter what the future holds.

FAQ – Frequently Asked Questions about the Economic Outlook

What are the key economic indicators to watch?

Key indicators include GDP growth, unemployment rates, inflation rates, and consumer confidence, as they all help assess the economy’s health.

How can businesses adapt to changing economic conditions?

Businesses can adapt by diversifying their offerings, managing costs, and staying informed about market trends to make agile decisions.

What should consumers do in response to economic changes?

Consumers should review their budgets, build emergency savings, and make informed spending decisions based on the economic climate.

Why is understanding economic trends important for financial planning?

Understanding economic trends helps individuals and businesses anticipate changes, allowing for better financial planning and risk management.