Projected market responses to Federal Reserve moves

Projected market responses to Federal Reserve moves significantly impact investment strategies, making it essential to track key indicators, historical reactions, and adjust portfolios accordingly to navigate financial markets effectively.

Projected market responses to Federal Reserve moves can significantly influence investment decisions. Have you ever considered how these changes affect your financial landscape? Let’s dive into the dynamics at play and their implications for investors.

Understanding Federal Reserve policies

Understanding the Federal Reserve policies is crucial for anyone looking to navigate the financial landscape effectively. The Fed plays a significant role in influencing economic activity and financial markets.

The Role of the Federal Reserve

The Federal Reserve, often referred to as the Fed, is the central bank of the United States. It manages the country’s money supply and sets monetary policy. This is done primarily through controlling interest rates and regulating financial institutions.

Key Tools Used by the Fed

The Fed employs various tools to exert its influence on the economy:

- Open Market Operations: Buying and selling government securities to influence the money supply.

- Federal Funds Rate: The interest rate at which banks lend to each other overnight. Adjusting this rate affects borrowing costs.

- Reserve Requirements: The amount of money banks are required to hold in reserve against deposits.

These tools help to ensure stable prices and maximum employment, which are the Fed’s main objectives. For example, lowering interest rates usually stimulates spending and investment, while raising them can help control inflation.

The Impact of Fed Policy on Markets

The actions of the Federal Reserve can lead to immediate shifts in market dynamics. Investors closely monitor announcements and policy changes. The anticipation of a rate hike or a decrease can cause stock prices to fluctuate, leading to investment decisions by both institutional and retail investors.

Understanding these reactions is key for making informed financial choices. For instance, when interest rates are expected to rise, the market might react negatively due to fears of higher borrowing costs. Alternatively, if the Fed signals an economic recovery, stock markets may rally in response.

Market analysts also examine Fed statements and the economic forecasts that accompany them to gauge future moves. They assess the implications these statements have on various sectors.

In summary, grasping the fundamentals of the Federal Reserve policies allows investors and the general public to make strategic decisions, keeping them well-equipped to adapt to changing economic conditions.

Impact of interest rate changes on the market

The impact of interest rate changes on the market is significant and complex. When the Federal Reserve adjusts interest rates, various sectors of the economy respond in different ways. Understanding these effects can help investors make informed decisions.

How Interest Rates Influence Market Behavior

Interest rates play a critical role in the economy. When rates rise, borrowing becomes more expensive. This typically leads to reduced consumer spending, affecting overall economic growth. Conversely, when rates drop, borrowing costs decrease, encouraging spending and investment.

Sector-Specific Reactions

Different market sectors react uniquely to changes in interest rates:

- Financial Sector: Banks often benefit from higher interest rates, as they can charge more for loans.

- Real Estate: Higher rates can lead to decreased demand for homes, slowing down the housing market.

- Consumer Goods: Companies selling non-essential items may see a decline in sales when borrowing becomes costly.

Additionally, interest rates affect the stock market significantly. A change can lead to shifts in investor sentiment, causing fluctuations in stock prices. Investors often reassess their portfolios based on these changes.

Moreover, international markets feel the effects as well. When the U.S. increases its rates, foreign investors may find U.S. assets more attractive, impacting global investment flows. Currency values can shift, affecting exports and imports, further intertwining global economies.

Understanding the ripple effects of interest rate changes helps investors position themselves strategically. Keeping an eye on the Federal Reserve’s announcements and economic indicators can provide insights into future market movements.

Key indicators to watch

When monitoring the Federal Reserve and its policies, several key indicators can provide valuable insights. By keeping an eye on these indicators, investors can make informed decisions about their financial strategies.

Economic Growth Indicators

One important indicator to watch is the Gross Domestic Product (GDP). GDP measures the overall health of the economy, and its growth rate can signal how policies may affect markets. A rising GDP often leads to increased spending and investment, while a declining GDP may indicate caution.

Inflation Metrics

Inflation rates are another critical factor. The Consumer Price Index (CPI) and the Producer Price Index (PPI) help gauge inflation trends. High inflation can prompt the Fed to increase interest rates, affecting both consumer behavior and investment decisions.

Employment Reports

Another vital set of data comes from employment reports, particularly the unemployment rate and job creation numbers. A strong job market can lead to increased consumer spending, which in turn influences inflation and economic growth.

- Job Openings and Labor Turnover Survey (JOLTS): This report shows the number of job openings and can indicate labor market strength.

- Non-farm Payrolls: Monthly reports that measure the change in the number of employed people in the economy.

- Average Hourly Earnings: Indicates wage growth, which can affect consumer spending and inflation trends.

In addition to these, consumer confidence indexes are useful as they reflect how optimistic consumers feel about the economy. High consumer confidence often encourages spending, which is crucial for economic growth.

Lastly, keeping an eye on interest rates themselves, such as the Federal Funds Rate, provides real-time insight into the Fed’s policy stance. Changes in this rate can lead to immediate shifts in market dynamics.

Historical market reactions to rate adjustments

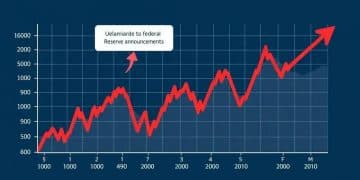

Historical market reactions to rate adjustments by the Federal Reserve can provide critical insights into how markets might behave in the future. Analyzing past events allows investors to gauge likely outcomes based on current economic data.

The Pattern of Market Responses

When the Fed announces a rate increase or decrease, the stock market often responds swiftly. Typically, a rate hike might lead to a market decline. Investors worry about higher borrowing costs and lower consumer spending. Conversely, when rates are cut, the market usually rallies, as it signals potential economic growth and lower costs for borrowing.

Key Historical Examples

Several historical adjustments illustrate these trends:

- 2008 Financial Crisis: The Fed lowered rates to near zero to stimulate the economy. The immediate reaction was a sharp rally in stock prices as investors regained confidence.

- Decisions in 2015: The Fed began increasing rates after years of low rates. This cautious increase led to mixed reactions in the market, with increased volatility as investors adjusted to changing conditions.

- COVID-19 Pandemic: In March 2020, the Fed slashed rates back to near zero to support the economy. This drastic action resulted in a rapid rebound in stock prices as markets adjusted to the new normal.

In each of these cases, the market’s initial reaction may not be the final destination. Often, stock prices will stabilize over time as investors assess the long-term impacts of the Fed’s decisions.

Understanding these historical patterns can equip investors with the knowledge to anticipate future reactions. By watching key indicators and comparing current data with the past, one can better navigate the complex landscape of stock market investments influenced by Federal Reserve policies.

Strategic investment approaches post-Fed announcements

Strategic investment approaches post-Fed announcements are essential for adapting to changes in the financial landscape. After the Federal Reserve makes a decision regarding interest rates, investors often reassess their portfolios to align with new market conditions.

Reassessing Investment Portfolio

One critical approach is to reassess your investment portfolio immediately after an announcement. Analyzing how different sectors are likely to react can help you make informed choices. For example, if the Fed cuts rates, sectors like real estate and technology might benefit from lower borrowing costs. In contrast, financial stocks could face challenges from reduced interest income.

Diversification Strategies

Implementing diversification strategies is another key tactic. By spreading investments across various sectors and asset classes, you can manage risk effectively. Here are some areas to consider:

- Defensive Stocks: Focus on companies that typically perform well during economic downturns, like utilities or consumer staples.

- Growth Stocks: Consider investing in growth-oriented sectors such as technology, which may thrive in a low-interest-rate environment.

- Bonds: Adjust your bond holdings to reflect changes in interest rates, opting for shorter maturities if rates are expected to rise.

Additionally, it’s essential to stay informed about global events. Economic indicators and geopolitical factors can also influence reactions to Fed announcements. By being proactive and adaptable, investors can capitalize on opportunities that arise after rate changes.

Another effective approach is using a tiered investment strategy. Allocate portions of your portfolio to various assets based on your risk tolerance post-announcement. This strategy allows you to balance between secure assets and higher-risk investments, adjusting as new information becomes available.

FAQ – Frequently Asked Questions about Projected Market Responses to Federal Reserve Moves

How do Federal Reserve decisions impact the stock market?

Federal Reserve decisions can lead to immediate reactions in the stock market, influencing investor sentiment and stock prices based on anticipated changes in interest rates.

What key indicators should I watch after a Fed announcement?

Key indicators include GDP growth rates, inflation metrics, employment reports, and consumer confidence indexes, which can all provide insights into potential market reactions.

What are some effective investment strategies after a Fed rate change?

Effective strategies include reassessing your portfolio, diversifying investments, and implementing a tiered investment approach based on risk tolerance and market conditions.

Why is it important to understand historical market reactions?

Understanding historical market reactions can help investors anticipate how current economic conditions and Fed decisions might influence future market behavior, enabling smarter investment decisions.